I have been citing Rebecca Smith’s excellent reporting on falling electricity demand in the US for almost five years. The Wall Street Journal’s editors deserve credit for keeping Ms. Smith on the electricity beat so she has the time to develop a deep understanding of the industry. Most media outlets don’t allow this kind of growth, and their reporters simply reprint industry press releases instead of doing real journalism.

Last week, Ms. Smith updated her longstanding coverage of the decline of US electricity demand and its dramatic impact on the US electrical industry. Here is a link to her story, but you will have to have a subscription to the WSJ to view it.

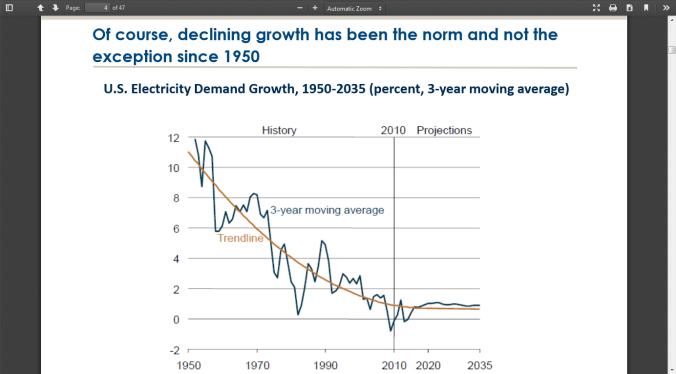

Ms. Smith’s story is a status report on the now well established disconnect between US load growth and economic growth, which I have also been covering here on The Power Line. A graph in her article, taken from the Dept. of Energy’s Energy Information Agency, shows that 2008 was the peak for annual US electrical production, with a total of 3.77 trillion kwh. Production has not reached that level in the five full years since then, and the EIA does not project any change in that trend in the future.

US power company mouthpieces claim that electricity demand will continue its past upward trend “when the economy turns around,” but the disconnect between economic growth and electrical load growth shows that this is unlikely to happen. So the US is now “past peak” in electricity demand.

As Ms. Smith puts it:

Utility executives across the country are reaching the same conclusion. Even though Americans are plugging in more gadgets than ever and the unemployment rate had dropped at one point to a level last reported in 2008, electricity sales are looking anemic for the seventh year in a row.

Sluggish electricity demand

Sluggish electricity demand reflects broad changes in the overall economy, the effects of government regulation and technological changes that have made it easier for Americans to trim their power consumption. But the confluence of these trends presents utilities with an almost unprecedented challenge: how to cope with rising costs when sales of their main product have stopped growing.

Sales volume

Sales volume matters because the power business ranks as the nation’s most capital-intensive industry. When utilities are flush with cash, they buy lots of expensive equipment and raise dividends for investors. When they’re selling less of their product, they look for ways to cut or defer spending. Regulators typically allow utilities to charge rates that are high enough to cover their basic expenses, but that doesn’t guarantee them strong profits. Utilities typically need to expand sales volume by 1% or more a year just to maintain their expensive, sprawling networks of power plants, transmission lines and substations, says Steven Piper, an energy analyst for SNL Energy, a research company. “That’s where the existential crisis is coming from,” he adds.

Historically, economic expansion meant expanding electricity sales. In fact, during the 1950s and 1960s, energy demand outpaced the growth in the gross domestic product. Then, from 1975 to 1995, GDP and electricity sales grew in tandem.

But the connection now appears to be broken. The U.S. Energy Information Administration said recently that it no longer foresees any sustained period in which electricity sales will keep pace with GDP growth. [emphasis in original]

Ms. Smith points to a number of factors, including customer generated solar power and energy efficiency investment, as major causes of the industry’s problems:

Local Solar Power Generation

Increasingly, both residential and business customers are making their own power rather than buying it from utilities. In Arizona, for example, solar companies are siphoning off utility customers. Sherry Pfister, a retiree who once worked at the Palo Verde nuclear power plant 45 miles west of Phoenix, says she didn’t hesitate to lease solar panels for her home in Waddell, Ariz., and says the panels have cut her utility bill by a third. “Why isn’t everybody doing it?” she wonders. Her supplier, Sunnova Inc., wooed her with

solar panels that cost 70 cents a watt, a fifth of the cost in 2008. Solar energy “is the next shale gas,” says Sunnova Chief Executive John Berger, predicting it will upend the utility business.

Energy efficiency

Energy efficiency blunts the impact of population and economic growth, because upgrades in lighting, appliances and heavy equipment reduce energy needs. In 2005, the average refrigerator consumed 840 kilowatt-hours of electricity a year, according to the U.S. Energy Information Administration. A typical 2010 replacement needed only 453 kilowatt-hours of electricity.

Higher rates

As their sales have lagged behind, utilities have raised prices, and that, too, is discouraging use. Most U.S. households pay 12 cents a kilowatt-hour today, up one-third from a decade ago, according to EIA data. A 2012 study from the California Public Utilities Commission found that customers have had a “strong response to price changes.”

Consumers fight back

To fight rising costs, Washington, D.C., has hired a consultant to help cut its electricity use 20% by 2015—and to save $10 million a year. FirstFuel Software sniffs out waste at the district’s 400 buildings with the help of smart meters and special software. “We’re not going to win the grand innovation prize,” says Sam Brooks, head of energy and sustainability for the District of Columbia, but he adds that just turning off the lights and shutting off furnaces when buildings are unoccupied turns out to be an easy way to save money.

And Ms. Smith concludes with a quote from our old friend, FirstEnergy CEO Tony Alexander, trying desperately to put a happy face on the company’s future.

New utility business models

Utilities aren’t waiting for better times. They’re increasing spending on big solar projects and energy-efficiency programs for which they earn income as investors or managers. And many executives are searching for new services to offer. “The industry has been pretty resilient the past hundred years,” says Bill Johnson, chief executive of the Tennessee Valley Authority, which furnishes electricity to nine million people in seven states. “I wouldn’t count us out quite yet.”

Electricity demand also isn’t bleak everywhere. FirstEnergy Corp. based in Akron, Ohio, says demand is increasing from such industries as steel, auto, oil refining and chemical production. But that hasn’t been enough to make up for losses elsewhere. Anthony Alexander, the company’s chief executive, forecasts that it will take until 2016 at the earliest for its electricity sales to recover to prerecession levels. “It’s pretty much a lost decade,” he says.

I find it hilarious that Ms. Smith introduced the FirstEnergy paragraph with the words “isn’t bleak.” Go to yesterday’s Power Line post on UBS’s downgrade of FirstEnergy’s stock. In his analyst report, UBS industry specialist Julien Dumoulin-Smith said about FirstEnergy’s future, “It looks bleak.” Oops.